Do I Need an EIN for My LLC in 2025? Complete Guide

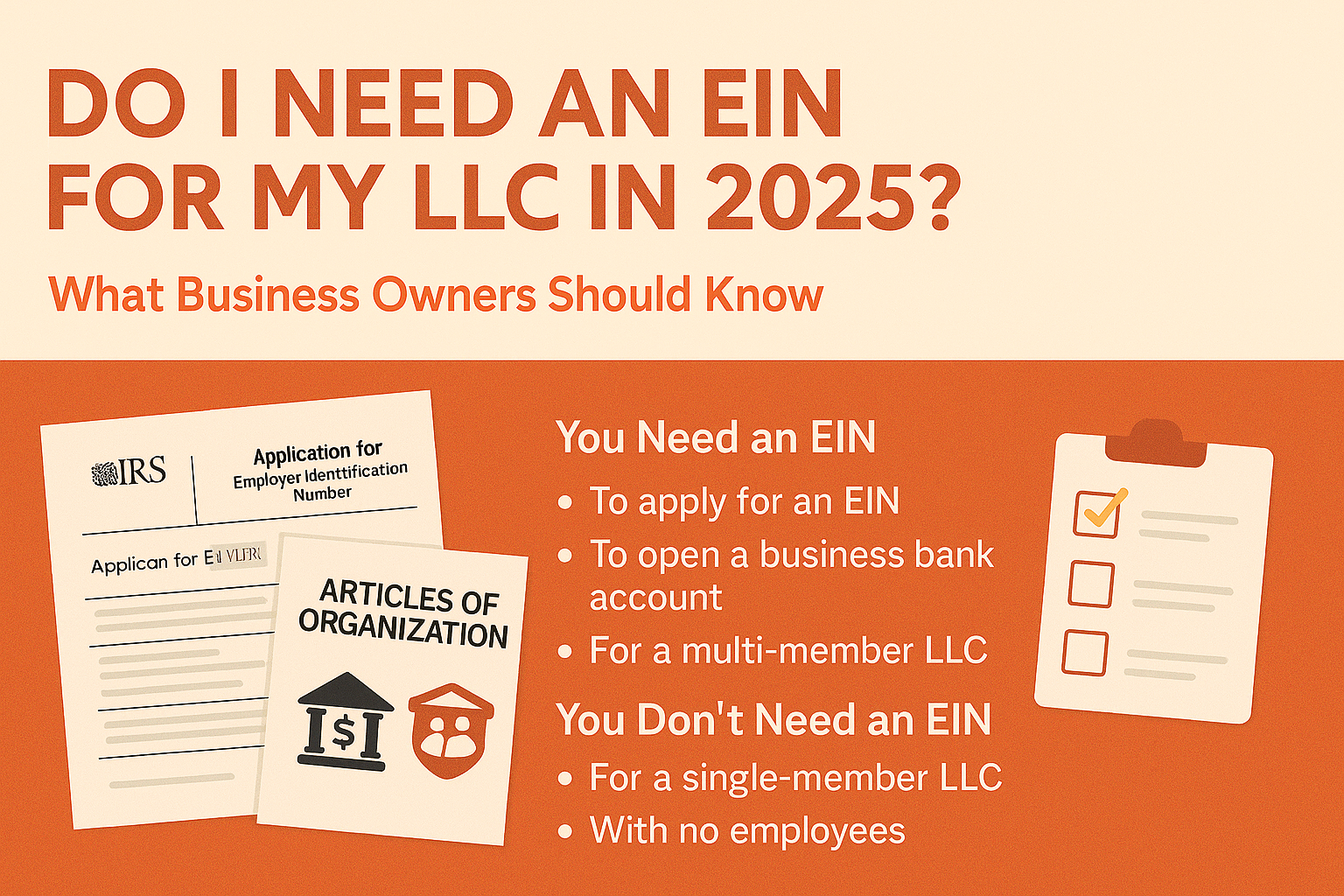

Forming an LLC in 2025? One of the most important steps after registration is determining whether you need an Employer Identification Number (EIN). This unique nine-digit number is issued by the IRS and is often referred to as a federal tax ID. But do all LLCs need one? Let’s break it down.

What Is an EIN?

An Employer Identification Number (EIN) is like a Social Security number for your business. It’s required for:

- Opening a business bank account

- Filing federal and state taxes

- Hiring employees

- Building business credit

Even if you’re a single-member LLC, getting an EIN can benefit you in many ways.

Who Needs an EIN in 2025?

You must obtain an EIN if your LLC:

- Has more than one member (multi-member LLC)

- Has employees

- Elects to be taxed as an S Corp or C Corp

- Is required to file excise taxes

- Withholds taxes for non-wage payments to a non-resident alien

Single-member LLCs without employees or corporate election may not legally need one, but banks and vendors often still require it.

Pro Tip: Even if not required, getting an EIN adds credibility to your business and separates personal and business finances.

How to Get an EIN for Your LLC

The easiest way to apply is online through the IRS EIN Assistant. It’s completely free and usually takes just minutes.

You can also apply by mail or fax using Form SS-4.

If you’re not comfortable doing it yourself, Ecommerce Linkers can help you handle the EIN application along with your full LLC formation process.

EIN and Business Bank Accounts

Most banks require an EIN to open a business account. This is true even if you’re a single-member LLC. Having an EIN helps you:

- Accept payments in your business name

- Build credit

- Keep finances separate from personal accounts

For a deeper dive, read: Choosing Between Physical and Online-Only Bank Accounts

EIN and Hiring Employees

You absolutely need an EIN if you plan to hire staff in 2025. It’s essential for:

- Reporting taxes

- Withholding income and Social Security

- Issuing W-2s and other IRS documents

International Founders: EIN Is Still a Must

Even if you’re a non-US resident, you still need an EIN for your U.S.-based LLC. In fact, it’s a critical step in:

- Getting a U.S. business bank account

- Filing taxes correctly

- Selling on platforms like Amazon

Start forming your LLC with us – we handle EINs for international clients too!

Final Thoughts: Don’t Skip the EIN in 2025

An EIN might seem like a small step, but it plays a big role in making your LLC fully functional. Whether you’re opening a bank account, hiring staff, or protecting your identity – an EIN is your LLC’s lifeline.

Need help? Contact Ecommerce Linkers now on WhatsApp and get your EIN and LLC sorted today.